As a business owner, you will always wonder if intangible assets are really worth their value. Most business owners feel that if you cannot touch intangible assets, would it be really worth? Most businesses have intangible assets and no asset list can be complete without entering the list of intangible assets. Most intangible assets are unique to businesses; however, there are many that are fairly common to specific businesses. Common intangibles assets include proprietary lists, beneficial contracts, patents, copyrights, trademarks, brand names, subscriptions and service contracts, goodwill, software, franchisee agreements etc.

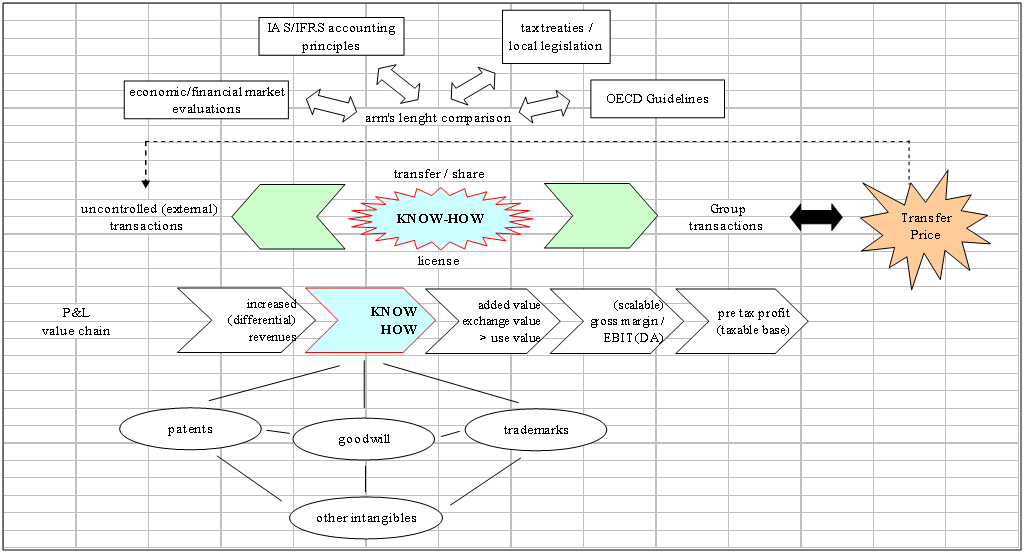

So, why do we need to carry out intangibles valuation of the aforementioned intangible assets? There are several reasons for valuating intangible assets. Some of the reasons for valuating intangible assets are: calculating an intercompany transfer price, quantifying a charitable deduction, determining a fair license rate, estimating damages in an infringement case, calculating an amortization deduction etc. Finding the value of intangible assets is also an important part of determining the value of a company for estate planning, marital dissolutions, shareholder rights cases, sale of a business, gift tax determination, conversion from C corporation to S corporation status etc.

For all organizations it is imperative to understand how intangible assets are valued because most organizations have intangible assets. There are three basic methods for finding the value of intangible assets. First is the cost of creation. Second is capitalization of income or savings and the third is the discounted cash flow. Although these methods are very accurate, you will find that there are many assumptions and estimates done during the valuation of intangible assets.

In the cost of creation method, the valuation experts will calculate what it would cost another business to copy or duplicate a given asset in the current time. One thing to be noted here is that this method will not calculate the asset’s future impact on company’s profits. This method will mainly look at the cost to develop an asset from scratch to its current form. The intangible assets that can be valued by the cost of creation method are software (internal) service contracts, patents, customer lists, trademarks, subscriptions, and copyrights.

In the capitalization of income or savings method, the valuation companies measure the future benefits of intangible assets in context to the company. It also calculates when the benefits will be generated and for how much time. The intangible assets that can be valued by the capitalization of income or savings method are brand names, trade names, trademarks, patents, and commercial software.

If the company has assets with predictable life spans and future financial benefits, then the discounted cash flow method of valuation is used. By using this method, valuation experts can value intangible assets such as Patent royalties, contracts, subscriptions, service contracts etc.

Valuing intangible assets is a very important component of determining the value of the company’s business. Intangible assets are very difficult to define and finding their value is also a daunting task. Intangibles valuation needs skills and experience, so, make sure that you have the right service for this job.